Amortization Strategy: Is a Long or Short Term Better for You?

Learn how mortgage amortization in Mississauga affects payments, interest, and equity. Choose the right term with help from a trusted local real estate agent.

Purchasing a house in Mississauga is a significant decision, and one must know how mortgage amortization works to make the right financial decisions. The length of amortization will determine how much you pay as interest and what makes up your monthly payment. Going through your first home purchase or the mortgage renewal, the matter of choosing the appropriate term can affect your budget and your financial plans. The best way to go about this is to find a reputable real estate agent in mississauga, who will advise you on the lowest mortgage rates in mississauga and make your planning stress-free.

Understand Mortgage Amortization in Mississauga

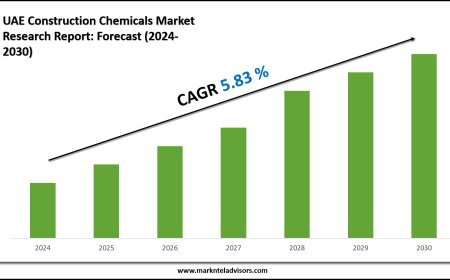

Mortgage amortization is simply the repayment of your home loan on a scheduled basis that includes both principal and interest. Most people in the city of Mississauga prefer to have an amortization period of 15 and 30 years, depending on their financial objectives. An amortization table shows what proportion of your loan is paid off with each payment, as interest payments are paid off early and principal payments later. This is important to know when purchasing a home- when using a capable real estate agent in Mississauga, you will make such mortgage decisions informed.

A Longer Mortgage Amortization: Why Consider It?

An amortization period of over 25 years or 30 years reduces your monthly payments, and thus easier to cover the cost of owning a home in Mississauga's competitive real estate market. This strategy, along with the other factors as the lowest mortgage rates in mississauga can make your home purchase more affordable without affecting your long-term financial stability.

The main benefits of a longer amortization

Lower payments each month: It is simpler to balance the flow of your cash and plan for other expenses.

More versatility: It enables you to pay off more expensive debts or invest in other places.

Controlling risks: Reduced dependency on funds in case of financial fluctuations or sudden emergencies that require

more time to create equity. Though the payoff is slow on your home, at least you accumulate equity.

Understand Shorter Mortgage Amortization

Choosing a shorter amortization, such as 15 or 20 years, implies paying a larger sum each month, but enables you to pay off your mortgage earlier and save a good deal of interest throughout that time. This is the best solution for homeowners who are more concerned with long-term savings and quicker equity gains. To help you estimate your financial conditions and select the mortgage solution that suits your objectives and is useful on your way to the achievement of homeownership, it is advisable to cooperate with an experienced real estate agent in mississauga.

The main benefits of a Shorter Mortgage Amortization

lower total interest paid: This will save you a lot of interest, up to tens of thousands of dollars

Quicker growth in equity: It will take you less time to own your house entirely

Mandatory savings: The increased expenses set aside low disposable income that you can use to preserve more money in the long term

Better financial liberation: When you clear off your mortgage, you have more cash to be able to devote to other goals.

Mississauga Mortgage Amortization Comparison: Shorter vs. Longer

A small amortization period or a long one, you should rely on the priorities of your finances. A faster amortization (20 years, instead of 30 years) also implies a larger number of monthly loans, fewer interests, and a more speedy increase in equity. As a contrast, a longer amortization (e.g., 30 years) permits lower payments and more monthly flexibility, but increases interest payments in the long run and reduces the rate of gaining equity. When people are shopping for a mortgage, the lowest mortgage rates in Mississauga could make the two options more affordable and financially productive.

Final thought

The right mortgage amortization period in Mississauga depends on the financial goals you set and how much you are comfortable with. A longer amortization comes with cheaper monthly payments and flexibility by being able to take care of other bills. A shorter amortization will make you save more in interest and develop equity quicker at the expense of higher payments on a monthly basis. To make the right choice in Mississauga, it is essential to talk to an experienced real estate agent in mississauga, and realize your possibilities and the possible course of actions as per your needs and future economic interests.