Smart Ways to Lower Your Auto Insurance Costs in Pennsylvania

Looking to save money on auto insurance in Pennsylvania? Discover expert tips for lowering your premiums, from adjusting coverage to bundling policies for discounts.

Car insurance is a necessity for every driver, but it doesnt have to drain your wallet. If you live in Pennsylvania, you already know rates vary widely depending on your driving record, vehicle type, and even where you park your car. The good news? There are proven strategies to keep your premiums reasonable while maintaining the protection you need.

Whether youre a new driver or a long-time resident looking to save money, this guide will help you find affordable vehicle coverage in PA without sacrificing quality.

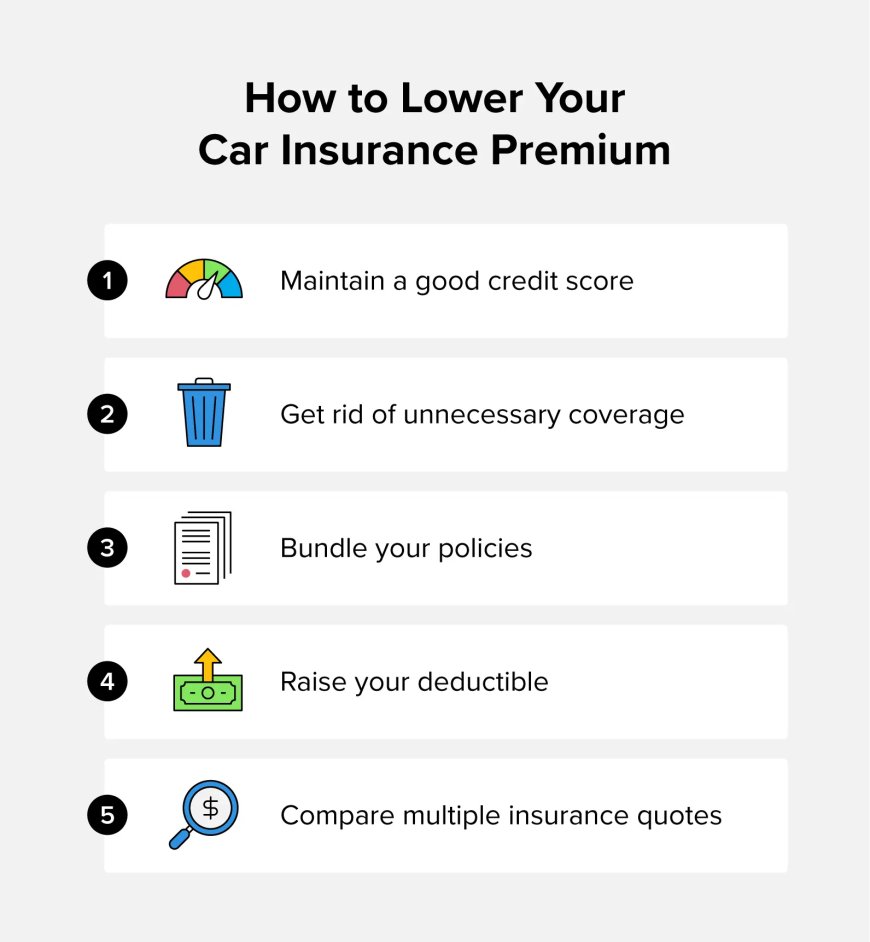

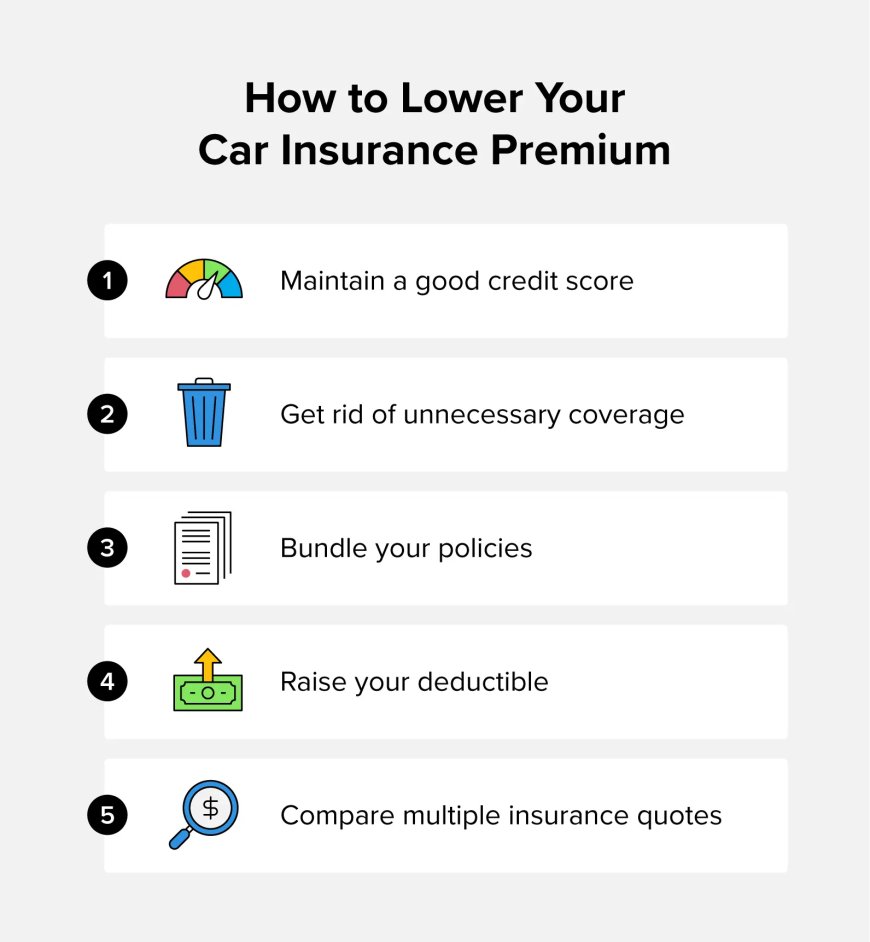

7 Ways to Lower Car insurance Premium in Pennsylvania

1. Shop Around and Compare Multiple Quotes

No two insurance companies price policies the same way. Some weigh your driving record heavily, while others focus more on your location or vehicle type. By getting at least three different quotes, you can quickly spot the most competitive offer.

Many drivers in Pennsylvania discover that smaller, regional insurers sometimes offer better rates than large national brandsespecially if they cater to local drivers needs.

2. Adjust Your Coverage Based on Vehicle Value

If you drive an older car, it might not make sense to carry full collision and comprehensive coverage. As a rule of thumb, if your annual premium is more than 10% of your cars current value, consider dropping certain coverages.

For newer vehicles, however, maintaining comprehensive coverage is essentialespecially if you have a loan or lease. The key is to balance protection with realistic costs.

3. Increase Your Deductible

A higher deductible lowers your monthly or annual premium. If you can afford to pay more out-of-pocket after an accident, you could save 1530% on your insurance.

Example: Raising your deductible from $500 to $1,000 could significantly reduce your premiumjust make sure you keep enough in savings to cover it if needed.

4. Bundle Policies for Multi-Policy Discounts

Most insurers offer multi-policy discounts when you bundle auto insurance with your homeowners or renters insurance. This can save you anywhere from 5% to 20% on both policies.

Even if you dont own a home, bundling with renters or life insurance can still unlock valuable savings.

5. Keep a Clean Driving Record

Safe driving pays offliterally. Avoiding traffic violations and at-fault accidents can dramatically lower your rates over time. In Pennsylvania, a single speeding ticket can raise your premium by 1525%, while a DUI could double it.

Taking a PennDOT-approved defensive driving course may also earn you a discount, especially if youre an older driver.

6. Take Advantage of Mileage-Based or Telematics Programs

If youre not a frequent driver, usage-based insurance (UBI) could help you save. Many insurers in PA now offer pay-as-you-drive programs that track your mileage and driving habits via a mobile app or device.

Low-mileage driversespecially retirees or work-from-home professionalsoften see significant savings with these programs.

7. Improve Vehicle Security

Cars with anti-theft devices, GPS trackers, and advanced safety features typically qualify for lower premiums. If you live in a high-risk area for theft or vandalism, this upgrade can make a noticeable difference.

Even something as simple as parking in a garage instead of on the street may reduce your risk profile in the eyes of insurers.

Expert Tip: Reevaluate Annually

Your life changes, and so should your insurance. Moving to a new ZIP code, paying off a car loan, or simply aging into a lower-risk category could all trigger lower rates. Dont just auto-renewreview your policy annually to make sure it still fits your needs.

Remember, staying proactive is the key to consistently finding affordable vehicle coverage in PA while keeping the right level of protection.

Final Thoughts

Auto insurance in Pennsylvania doesnt have to be complicated or costly. By shopping smart, maintaining a clean driving record, and taking advantage of available discounts, you can keep your premiums low without sacrificing essential protection.

The best part? These strategies work whether youre in Pittsburgh, Philadelphia, or anywhere in betweenbecause insurers always reward drivers who actively manage their risk.