What You Should Know About Zero Down Payment Mortgages in Dubai

Dubais real estate market has always been a beacon for investors and homebuyers looking to own a slice of luxury. In recent years, a new trend has begun to shape buyer behavior: the rise of zero down payment mortgage options. This initiative is changing the game for many first-time buyers and investors by removing one of the biggest financial barriers to entry the upfront cost.

In this article, well explore everything you need to know about zero down payment mortgages in Dubai, their benefits, potential risks, and how developers like DAMAC Properties are playing a pivotal role, especially with projects such as DAMAC Safa One.

What is a Zero Down Payment Mortgage?

Traditionally, buying a property in Dubai required a down payment of at least 20% for expatriates and 15% for UAE nationals. This amount could run into hundreds of thousands of dirhams, making it difficult for many to enter the market. A zero down payment mortgage, however, allows buyers to finance 100% of the propertys value without having to pay anything upfront.

This model has gained traction among property developers and financial institutions aiming to increase home ownership and drive real estate sales.

Benefits of a Zero Down Payment Option

Easier Entry into the Market

The primary benefit of a zero down payment mortgage is that it lowers the barrier to entry for first-time homebuyers. Individuals who might not have substantial savings can now secure a property in prime locations without delay.

Preserve Your Cash Flow

Instead of locking a significant portion of your cash into a down payment, buyers can use that money for other investments, emergencies, or lifestyle improvements. This is especially appealing to entrepreneurs and business owners who prefer to keep liquidity for operational flexibility.

Access to Premium Developments Like DAMAC Safa One

Prestigious projects by DAMAC Properties, such as DAMAC Safa One, are now within reach of a broader range of buyers. These properties offer high-end amenities, luxury finishes, and prime locations all available without requiring an upfront financial commitment.

Who Offers Zero Down Payment Mortgages in Dubai?

Several banks and real estate developers in Dubai now offer this facility, either directly or through special partnerships. While some financial institutions provide 100% financing, others collaborate with developers to offer structured payment plans that mimic zero down payment schemes.

DAMAC Properties is a notable example, often providing attractive financing options either internally or in cooperation with lending partners. Their luxury projects like DAMAC Safa One are prime examples where such schemes are applied to ease buyer access.

Spotlight on DAMAC Properties and DAMAC Safa One

DAMAC Properties is one of the UAEs leading luxury real estate developers, known for creating exceptional residential, commercial, and leisure properties across the region. With a reputation for delivering innovative and stylish living spaces, DAMAC Properties is now catering to the evolving needs of buyers by introducing flexible payment plans and zero down payment options.

Why DAMAC Safa One is Gaining Attention

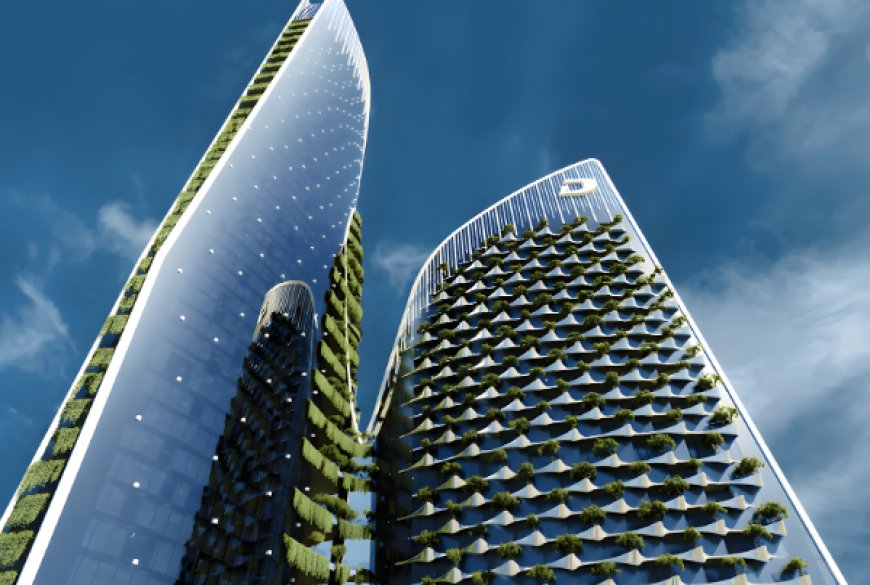

DAMAC Safa One is a standout development located near Safa Park and Sheikh Zayed Road, offering breathtaking views of Dubais skyline and the Arabian Gulf. Designed in collaboration with De Grisogono, the project features two luxurious towers with opulent interiors, sky gardens, and world-class amenities.

Thanks to zero down payment financing, many aspiring homeowners and investors can now consider owning a unit in DAMAC Safa One without the financial stress of a large initial deposit.

Things to Consider Before Choosing a Zero Down Payment Plan

While the benefits are clear, there are a few key considerations to keep in mind when opting for a zero down payment mortgage in Dubai.

First, monthly installments will generally be higher since the full property value is being financed. This means a greater financial commitment over time. Second, a larger loan also typically results in more interest paid across the term of the mortgage. Its important to calculate the long-term cost, not just the short-term convenience.

Additionally, not all buyers will qualify. Banks often require a strong credit score, steady income, and low existing debt to approve a zero down payment loan. Lastly, such offers are limited to selected properties and promotional periods. For example, DAMAC Properties may provide this benefit only on certain units within DAMAC Safa One, and for a limited time.

How to Apply for a Zero Down Payment Mortgage in Dubai

Applying for a zero down payment mortgage follows a similar process to traditional home loans, with a few variations. Heres a general outline:

-

Choose a bank or real estate developer offering zero down payment financing.

-

Submit required documents: Emirates ID, passport, salary certificate, bank statements, and credit report.

-

Get a pre-approval to understand how much you can borrow.

-

Select a property that qualifies for the scheme, such as units in DAMAC Safa One.

-

Finalize the sales agreement and mortgage approval.

-

Sign the deal and take possession without an upfront down payment.

Real-Life Scenarios Where Zero Down Payment Works Best

There are specific buyer profiles that benefit greatly from this mortgage solution:

-

Young professionals with limited savings but high income potential.

-

First-time buyers who want to enter the Dubai market without delay.

-

Expats who recently relocated and are still building their financial foundation.

-

Investors looking to expand their portfolio without tying up large amounts of capital.

Developers like DAMAC Properties cater to these groups by offering flexible terms, especially in high-demand projects such as DAMAC Safa One, making luxury real estate more accessible than ever.

Key Differences Compared to Traditional Mortgages

Unlike traditional mortgages, which require a minimum down payment of 15%20%, zero down payment options eliminate this hurdle entirely. While traditional loans have lower monthly repayments and reduced interest over time, they also demand a large upfront capital commitment. On the other hand, zero down payment mortgages allow buyers to get started sooner but involve higher monthly costs and stricter eligibility requirements. Choosing between the two depends on your financial flexibility and long-term goals.

Final Thoughts on Embracing Zero Down Payment in Dubai

The introduction of zero down payment mortgage options in Dubai is reshaping the way people approach real estate. By removing the biggest hurdle the initial financial burden these plans offer a path to homeownership for many who were previously sidelined.

With trusted developers like DAMAC Properties leading the way and premium developments such as DAMAC Safa One now within reach, buyers can finally take a confident step toward luxury living without waiting years to save for a down payment.

Whether you're a first-time buyer or a seasoned investor, understanding the pros, cons, and application process of zero down payment mortgages will help you make informed decisions in one of the worlds most dynamic property markets.