Chart Patterns Crypto: Unlocking 2025’s Trends with Minable Coins

Entering the crypto market in 2025 is comparable to climbing a digital treasure hunt in which the use of the Chart Patterns Crypto can unlock unknown potential by analyzing such a thing as a bullish flag or a double top

Entering the crypto market in 2025 is comparable to climbing a digital treasure hunt in which the use of the Chart Patterns Crypto can unlock unknown potential by analyzing such a thing as a bullish flag or a double top. In the meantime, the process of cryptocurrency mining is a concrete alternative to the acquisition of access to coins through the provision of blockchain protection, and such minable currencies as Kadena are emerging. With Web3 initiatives, either in the form of decentralized finance (DeFi) or play-to-earn (P2E) games, gathering momentum in the market place, are paths of charting and mining possible to capture the gains of 2025? Considering the combination of precision and mining rewards, they also can help to walk among the crypto landscape, and this is the way technical analysis and minable coins can be discussed.

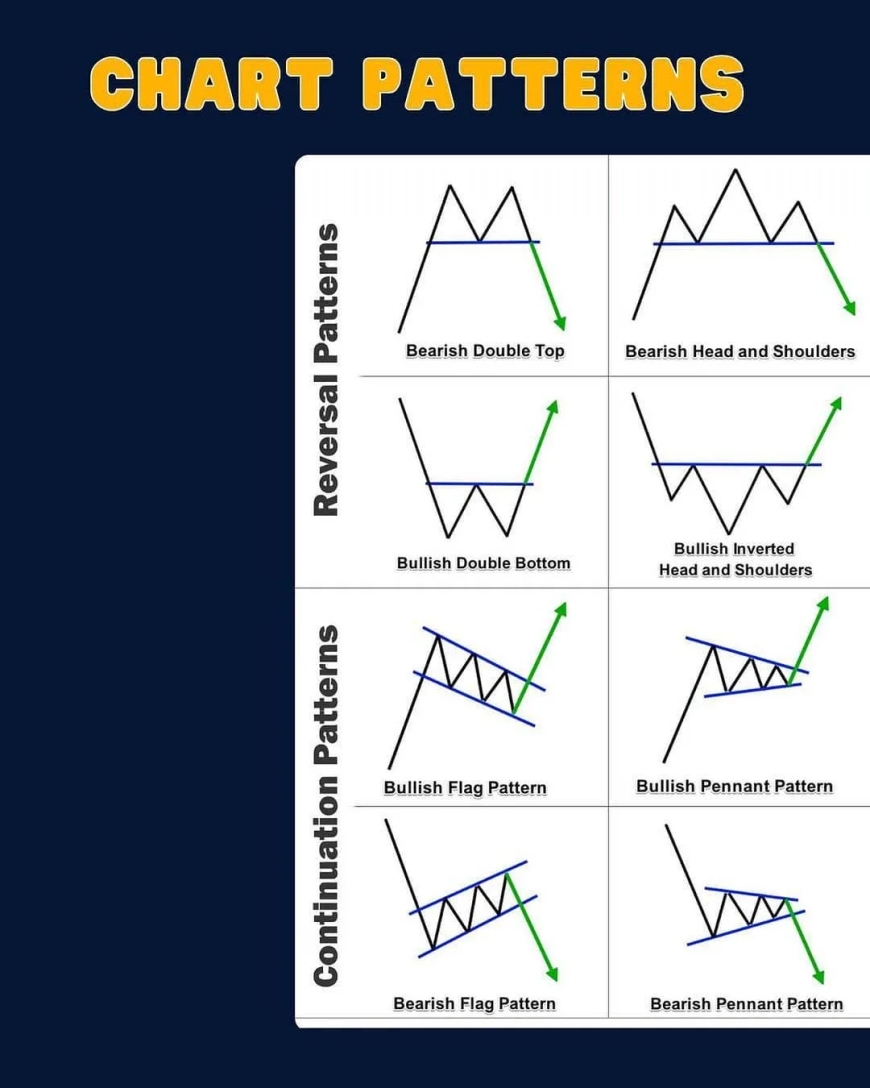

Decoding Chart Patterns

The chart patterns serve as a guide of the crypto trader by guiding based on the market mood through the use of market shapes such as the ascending triangles or head-and shoulder-shapes. Chart Patterns Crypto plays a critical role in identifying trends in an emerging market driven by Web3 adoption and institutional activity in 2025. The formation of a cup-and-handle on the Ethereum chart may be the indication of a growth up to $5,000, whereas the bearish wedge on Bitcoin chart may indicate its fall down to $50,000. It is literally a head-scratcher how these trends, governed by psychology, determine billion trades as, with the example of Solana in 2024, you could see how it went from $120 to $180.

On X, traders focus on such trends as falling wedges on coins such as HNT, which very frequently result in 15-20% pump clasts, according to CoinMarketCap. Pattern provides nothing but probabilities and the only way to decipher the market movements in 2025 is by mastering the patterns.

Why Patterns Excel in Crypto

Crypto markets thrive on volatility, shaped by retail FOMO, regulatory news, and macro events like the 2024 Bitcoin halving. Chart patterns shine by revealing order in the chaos. A symmetrical triangle on GALA signaled a 25% surge in 2024, per TradingView. In 2025, with DeFi tokens like AAVE and P2E coins like Axie Infinity trending, patterns guide traders to high-potential opportunities.

Patterns work because they capture human behavior. Resistance levels, like Bitcoin’s $70,000 ceiling, hold until sentiment shifts. False breakouts can mislead, so pairing patterns with indicators like RSI or volume spikes enhances precision. I’ve noticed traders who combine these tools consistently outperform in crypto’s wild swings.

Top Patterns for 2025

Bullish patterns like double bottoms and ascending triangles are 2025’s stars. A double bottom on Render at $3.80 triggered a 10% rally, per CCN. Spotting these early can unlock profits, especially for altcoins with strong use cases.

Enhancing Patterns with Indicators

Patterns gain strength with confirmation. A bullish pennant on AAVE with an RSI below 30 signals an oversold buy. In 2025, tools like TradingView let traders layer patterns with MACD or Bollinger Bands, sharpening entry and exit points.

Patterns Driving 2025’s Market

What powers Chart Patterns Crypto in 2025? Sentiment and adoption. The 2024 halving and pro-crypto policies are fueling a bull cycle, with altcoins like GALA forming bullish flags, signaling 20-30% gains, per X posts. Institutional moves, like Grayscale’s 30% allocation to AAVE, create predictable patterns, with AAVE’s recent breakout from $280 to $350 following a cup-and-handle. Regulatory risks, like a 2025 DeFi clampdown, could spark bearish patterns, such as Bitcoin’s head-and-shoulders dropping to $45,000, per CryptoNewsZ.

Altcoins often trail Bitcoin’s patterns but can surge independently on news like partnerships. A bullish triangle on HNT signaled a 15% pump after a T-Mobile deal. Staying agile with patterns is crucial in 2025’s dynamic market.

The Landscape of Minable Coins

Mining secures blockchains and rewards miners with tokens, and What Crypto Can Be Mined is a hot question in 2025. While Bitcoin’s ASIC-heavy mining dominates, GPU-friendly coins like Kadena (KDA), Ravencoin (RVN), and Flux (FLUX) are accessible for hobbyists. Kadena yields $0.05-$0.12 daily per RTX 3060, per WhatToMine, while Ravencoin offers $0.03-$0.08. X posts highlight Kadena’s 150% yearly gain, driven by its scalable layer-1 blockchain.

Mining’s profitability hinges on electricity costs ($0.15/kWh average in the U.S.) and market prices. Decentralized pools like FluxNodes lower barriers, offering 5-8% ROI annually, per Flux’s site. Minable coins with strong fundamentals can align with bullish patterns, amplifying trading opportunities.

Strategies for Patterns and Mining

How do you win with Chart Patterns Crypto and mining? Master patterns first. A bullish flag on HNT with high volume signals a buy, targeting 10-15% gains. Use TradingView to spot setups like GALA’s ascending triangle, aiming for $0.05-$0.10. For mining, focus on What Crypto Can Be Mined, like Kadena or Ravencoin, using efficient GPUs (RTX 4070 yields $0.10-$0.15 daily). Join pools like MineXMR for Monero to boost returns, offering 3-5% monthly ROI.

Diversify by trading pattern-driven coins like AAVE alongside mining rewards. Monitor X for news; a partnership announcement can spark a breakout. Set stop-losses at 5% below support (e.g., HNT’s $2.25) and mine in low-cost regions (under $0.10/kWh). It’s a pretty darn sharp move to blend technicals with mining for 2025 profits.

Conclusion

In 2025, chart patterns and minable coins are a winning combo, guiding traders through volatility and offering tangible rewards. Patterns like double bottoms and triangles signal high-probability trades, while coins like Kadena and Ravencoin provide mining profits, though energy costs demand strategy. Combine pattern analysis with selective mining, using tools like TradingView and WhatToMine for insights. Monitor X for sentiment and stay alert for regulatory shifts. The crypto treasure map is yours to follow, and with precision and discipline, you can unlock 2025’s gains.