Gas Chromatography Market Size, Growth, and Forecast 2025-2033

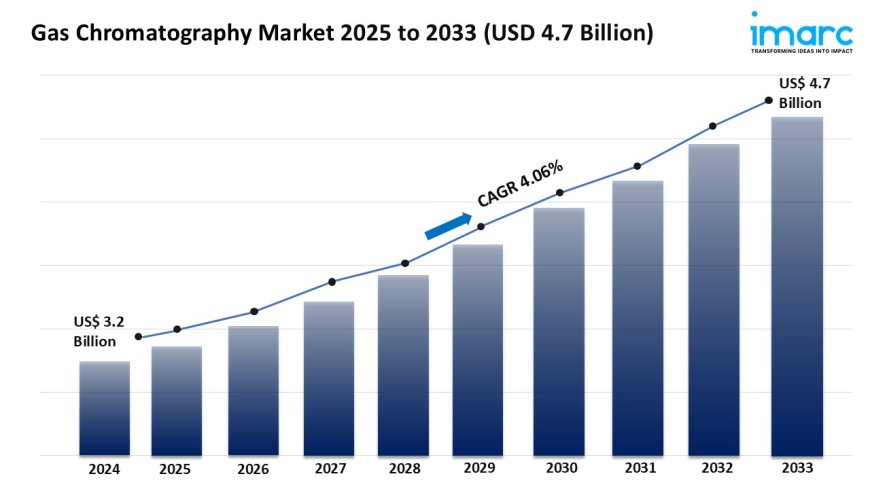

The global gas chromatography market size reached USD 3.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.06% during 2025-2033.

Market Overview:

The gas chromatography market is experiencing rapid growth, driven by increasing demand in pharmaceutical and biotechnology industries, advancements in technology and instrumentation, and rising applications in environmental monitoring. According to IMARC Groups latest research publication, Gas Chromatography Market Report by Product (Accessories and Consumables, Instruments, Reagents), End Use Industry (Pharmaceutical, Oil and Gas, Food and Beverage, Agriculture, Environmental Biotechnology, and Others), and Region 2025-2033, the global gas chromatography market size reached USD 3.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.06% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/gas-chromatography-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Gas Chromatography Market

- Increasing Demand in Pharmaceutical and Biotechnology Industries

The pharmaceutical and biotechnology sectors are major drivers of the gas chromatography (GC) market due to their need for precise analytical tools. GC systems are critical for drug development, quality control, and ensuring compliance with stringent regulatory standards. For instance, in pharmaceutical manufacturing, GC is used to analyze residual solvents in drug formulations, ensuring patient safety. A case study involving a leading pharmaceutical company demonstrated that implementing advanced GC systems reduced solvent detection times by 30%, enhancing production efficiency. As these industries expand globally, particularly in emerging markets, the demand for reliable GC systems continues to rise, fueling market growth.

- Advancements in Technology and Instrumentation

Technological innovations in gas chromatography systems, such as improved detectors and automated sample handling, are significantly boosting market growth. Modern GC systems offer enhanced sensitivity, faster analysis, and user-friendly interfaces, making them indispensable in various applications. For example, the development of high-resolution mass spectrometry coupled with GC has enabled more accurate detection of trace compounds in environmental samples. A notable case is a research lab that used a GC-MS system to identify micro-pollutants in water, aiding in environmental policy formulation. These advancements attract industries seeking cutting-edge solutions, driving investment and adoption in the GC market.

- Rising Applications in Environmental Monitoring

Environmental monitoring is a key growth factor for the GC market, driven by increasing global concerns about pollution and climate change. GC systems are widely used to analyze air, water, and soil samples for contaminants like volatile organic compounds (VOCs). For instance, a government agency in Europe employed GC to monitor VOC emissions from industrial plants, ensuring compliance with environmental regulations. As governments worldwide implement stricter environmental policies, the demand for GC systems grows. This trend is particularly strong in regions with heavy industrial activity, where accurate monitoring is critical to public health and sustainability efforts.

Key Trends in the Gas Chromatography Market

- Integration with Automation and Data Analytics

The integration of automation and data analytics into gas chromatography systems is a prominent trend reshaping the market. Automated GC systems streamline workflows, reduce human error, and enhance reproducibility. For example, a food safety lab implemented an automated GC system to test pesticide residues, cutting analysis time by 40% and improving data accuracy. Additionally, advanced software now allows real-time data analysis and predictive maintenance, enabling labs to optimize performance. This trend is particularly appealing to high-throughput industries like food and beverage, where efficiency and data-driven insights are critical for maintaining competitive edges.

- Growing Adoption in Food and Beverage Testing

The food and beverage industry is increasingly adopting gas chromatography for quality assurance and regulatory compliance. GC is used to detect contaminants, verify product authenticity, and analyze flavor profiles. A notable case involved a winery using GC to analyze volatile compounds in wine, ensuring consistent flavor profiles across batches. As consumer demand for safe and high-quality food products rises, GC systems are becoming essential for testing pesticides, additives, and spoilage markers. This trend is amplified by global trade, where stringent import regulations require rigorous testing, driving demand for advanced GC solutions in this sector.

- Expansion of Portable and Miniaturized GC Systems

The development of portable and miniaturized gas chromatography systems is a significant trend, enabling on-site and real-time analysis. These compact systems are ideal for field applications, such as detecting hazardous gases at industrial sites or monitoring air quality in remote areas. For example, a disaster response team used a portable GC system to assess chemical leaks during an industrial accident, enabling rapid decision-making. The portability and ease of use of these systems make them attractive to industries like oil and gas, environmental monitoring, and forensics, where immediate results are critical, thus expanding the markets reach.

Leading Companies Operating in the Global Gas Chromatography Industry:

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Chromatotec

- Merck KgaA

- PerkinElmer Inc.

- Phenomenex Inc. (Danaher Corporation)

- Restek Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- W. R. Grace and Company

- Waters Corporation

Gas Chromatography Market Report Segmentation:

By Product:

- Accessories and Consumables

- Columns and Accessories

- Fittings and Tubing

- Auto-sampler Accessories

- Flow Management and Pressure Regulator Accessories

- Others

- Instruments

- Systems

- Auto-samplers

- Fraction Collectors

- Detectors

- Flame Ionization Detectors (FID)

- Thermal Conductivity Detectors (TCD)

- Mass Spectrometry Detectors

- Others

- Reagents

- Analytical Gas Chromatography Reagents

- Bioprocess Gas Chromatography Reagents

Accessories and consumables (columns and accessories, fittings and tubing, auto-sampler accessories, flow management and pressure regulator accessories, and others) exhibit a clear dominance in the market attributed to their frequent replacement and critical role in ensuring optimal performance.

By End Use Industry:

- Pharmaceutical

- Oil and Gas

- Food and Beverage

- Agriculture

- Environmental Biotechnology

- Others

Food and beverage hold the biggest market share owing to the implementation of stringent regulations and the need for accurate analysis of ingredients and contaminants.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market due to the strong presence of key players and high adoption of advanced chromatography techniques.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145